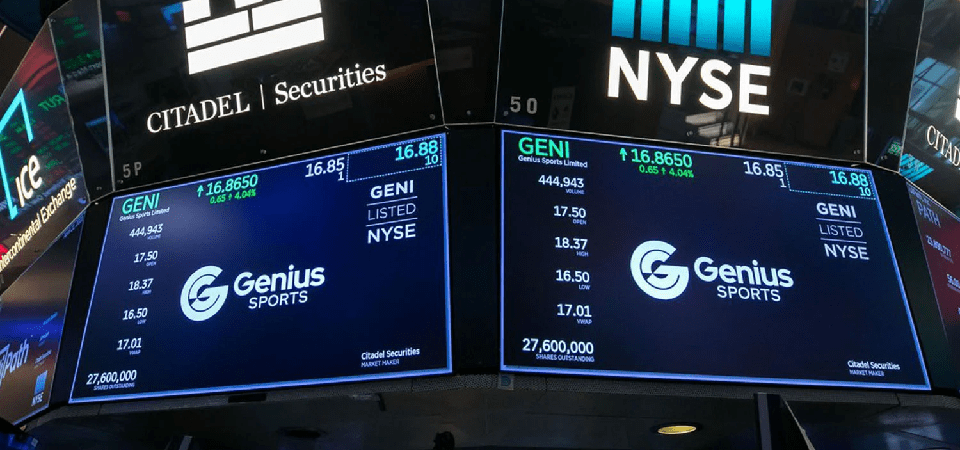

Genius Sports Soars on Surprise Profit, Upped Outlook

Genius Sports (NYSE: GENI) reported a surprising third-quarter profit and increased its 2024 financial projection, which caused the company's shares to soar Tuesday.

In late trading, shares of the sports betting data provider were up over 16% on quadruple the typical daily volume, on a day when the majority of gaming equities fell victim to some profit-taking. With profits before interest, taxes, depreciation, and amortization (EBITDA) of $26 million, Genius reported a third-quarter net income of $12.5 million to investors. During that time, $120 million was made. With $119 million in sales, the company had previously projected third-quarter EBITDA of $25 million.

The amount of net income was probably a major contributor to the bullishness of Genius stock today. In the case of the sports technology company, its third-quarter net income figure this year was a $24.1 million reversal from the year-earlier period in which it lost $11.6 million. This measure is a more accurate representation of a company's profitability than EBITDA.

In addition to signing another social media agreement, this time with Reddit, Genius expanded its data partnership with ESPN during the quarter to add more data to college sports, NBA, and WNBA broadcasts. Genius Sports provides improved statistics to people participating in NFL-related forums on that platform.

Genius Lifts Guidance for 2024

Genius increased its 2024 EBITDA and sales target, further bolstering the stock's recent run and confirming that it is a catalyst-rich, high-growth story in the realm of sports betting equities.

"Genius Sports expects to generate Group Revenue of approximately $511 million and group adjusted EBITDA of approximately $86 million in 2024. This implies year-over-year group revenue and adjusted EBITDA growth of 24% and 61%, respectively,” according to a statement.

In the past, Genius has informed investors that it anticipates reporting $480 million in sales in 2024 along with $75 million in adjusted profits before interest, taxes, depreciation, and amortization (EBITDA). According to the revised estimate, Genius' top line would increase by at least 20% in 2024 for the fourth consecutive year.

The business also stated that it anticipates margins to increase by about 400 basis points this year, demonstrating that it is optimizing efficiencies. Compared to the previous year, Geneus reported a far larger loss from operations and transaction costs in the third quarter.

Anticipate a positive cash flow

The company's reiteration of its hopes to be cash flow positive in 2024—without offering specific cash flow estimates for the year—was another element that contributed to Tuesday's spike in Genius stock price.

“Given the multiple growth drivers across the business, we remain confident in our Q4 guidance of 38% revenue growth, over 2.5 times growth of adjusted EBITDA, 900 basis points of margin expansion and significant cash flow, bringing us to a positive position for the full year,” said CFO Nicholas Taylor on a conference call with analysts earlier today.

CEO Mark Locke discussed the rise in NFL live betting on the call. Genius is the league's sole data source. Companies like Genius can profit from the increasing data demands brought about by an increase in in-game wagering and same-game parlays.