Fertitta Wynn Stake to Be Scrutinized by NGCB

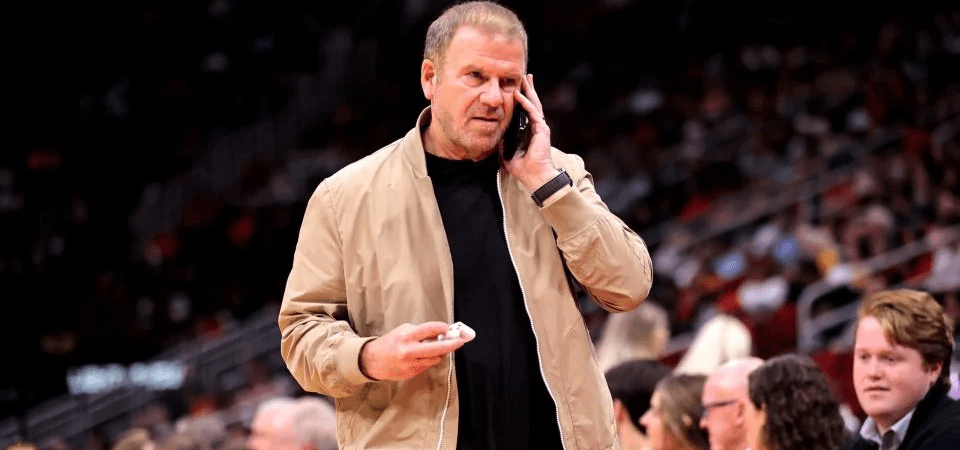

During its Wednesday meeting, the Nevada Gaming Control Board (NGCB) will evaluate Tilman Fertitta’s qualifications as a shareholder in Wynn Resorts (NASDAQ: WYNN), the casino operator where he is the primary investor.

This is a standard procedure because, according to Nevada law, investors who possess a minimum of 5% of publicly traded gaming firms operating within the state are required to undergo assessment by the NGCB and must obtain Nevada gaming licenses. Fertitta fulfills the latter criterion since three of his Golden Nugget casinos are properties licensed for gaming in Nevada. The locations of those venues are in Laughlin, downtown Las Vegas, and Lake Tahoe.

Currently the US ambassador to Italy, Fertitta will not be present at the NGCB meeting on June 11, nor will he participate through a conference call or online meeting, and he is not legally required to do so. Steven Scheinthal, the top lawyer at Fertitta Entertainment Inc., is expected to attend the meeting.

Scheinthal participated in recent meetings of the NGCB and Nevada Gaming Commission (NGC) concerning the licensing of Paige Fertitta — Tilman’s ex-wife — who has assumed leadership of the entertainment and leisure conglomerate while her former husband is in Italy.

Anticipate Inquiries Regarding Fertitta's Goals for Wynn

More than two years have passed since Fertita acquired a 6% share in Wynn, surprising both the gaming sector and the investment community. Since that time, his stake in the Encore operator has nearly tripled to 12.58%, easily positioning him as the largest shareholder in the firm.

Although it's improbable that there will be concerns about Fertitta’s fitness as a significant investor in Wynn, NGCB members may not refrain from questioning Scheinthal or another Fertitta representative about their previous leader's strategies for the Wynn investment.

Questions of this nature were brought up during a May NGCB meeting, where Schienthal mentioned that as long as Wynn management takes actions to increase shareholder value, his superior is fine with that; however, he noted, “we’ll see what happens,” which may have led to further questions from Commissioner George Assad, who inquired about any dissatisfaction Fertitta might have with Wynn executives concerning the declining share price.

The attorney avoided that pitfall, choosing not to address his ex-employer’s sentiments regarding Wynn’s shares dropping 10.35% in the last year.

Takeover Speculations Have Eased

Possibly because of Fertitta’s role as ambassador, rumors about Wynn being taken over have decreased. Such talk was widespread shortly after it was disclosed that the Houston Rockets became a Wynn investor in 2023.

Despite holding a 12.58% stake in the company that could facilitate change, Fertitta has not clearly indicated that he is pursuing major transactions like selling assets or a complete sale. At this point, his responsibilities might be too great to concentrate on a complicated, costly acquisition.

Several Wall Street analysts had earlier pointed out that Fertitta's chances of acquiring Wynn were slim, noting that his main focus on the gaming firm was to drive expansion and enhance the utilization of the operator's renowned brand.