Atlantic City Casino News: Profits Further Shrink, But All Nine Resorts in the Black

The nine casinos in Atlantic City have had a rough week. The state's casino regulator and industry watchdog, the New Jersey Division of Gaming Enforcement (DGE), said on Friday that gross operating profits for the nine properties along the shoreline decreased overall in the third quarter, following its Tuesday report that in-person gaming revenue fell 8.5% in October.

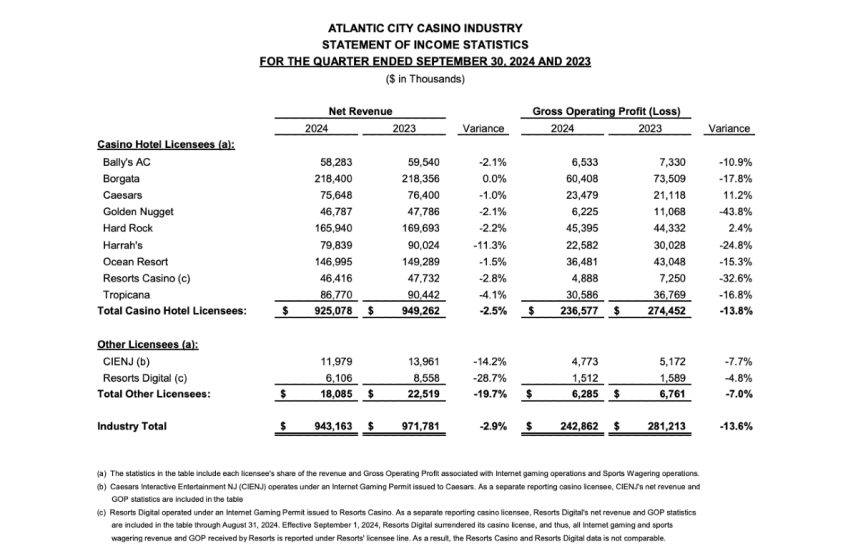

In July, August, and September, net revenue—which includes earnings from gaming, lodging, food and drink, and entertainment—dropped 2.5% to little over $925 million. Inflation-driven cost increases combined with lower revenue caused gross operating profits to plummet 13.8% to about $236.6 million.

According to each casino licensee's financial statement, gross profits are earnings before interest, taxes, depreciation, amortization, affiliate fees, and other miscellaneous factors. According to the DGE, it is a commonly used indicator of profitability in the Atlantic City casino industry.

In Q3, only two of the nine casinos reported higher profits. Caesars' operating profit of $23.5 million was an 11.2% increase over the previous year, while Hard Rock's profit of $45.4 million was a 2.4% gain.

Profits at the other casinos dropped from 10.9% at Bally's to as low as 43.8% at Golden Nugget.

Hotel Prices Drop

Through three quarters, all nine casinos maintained their profitability in spite of operational challenges. Profits dropped 9% to $576.6 million, while net revenue remained unchanged at $2.54 billion.

"For the third consecutive year, Atlantic City’s net revenue exceeded $2.5 billion in the first nine months of the calendar. Every casino was profitable in both the third quarter and year-to-date,” said James Plousis, chair of the New Jersey Casino Control Commission, which oversees the DGE."

However, Plousis acknowledged that profits are still declining.

“At the same time, pressure from continuing high costs can be seen in lower profits compared to the same period last year,” Plousis added.

The casinos in Atlantic City saw a decline in hotel income as a result of fewer tourists.

Compared to the same quarter last year, the resorts' stated occupancy rate of 84.1% represented a 1.5% decline. The average weekly rate in 2024 Q3 was $201, $17, or about 8% less than the usual rate of $218 in 2023 Q3, meaning that the accommodations were significantly less expensive.

At $336, Ocean had the highest rate. At $125, Golden Nugget had the most affordable rooms.

AC Difficulties

The casino sector in Atlantic City is confronted with numerous persistent obstacles. Inflation, rising labor costs due to a labor shortage, more regional competition in gaming, higher overall overhead for goods and third-party services, and a change in customer preferences following COVID-19 are some of these.

Online casino income increased by about 24% to $1.94 billion during the course of 10 months, while in-person casino revenue decreased 1.6% to $2.36 billion, a difference of over $38.7 million. Over the same ten months last year, iGaming platforms made nearly $373.3 million more.

Additionally, sports betting keeps expanding. Between January and October 2024, Garden State oddsmakers won more than $111.5 million, or more than $912.8 million, an increase of 14%.

DraftKings, FanDuel, BetMGM, Caesars Sportsbook, and other third-party partners receive a large portion of the winnings from Atlantic City casinos' iGaming and sports betting operations.